Should You Buy Gold or Silver First? Experts Explain

Investing in precious metals often raises the question: gold or silver? Each metal has distinct characteristics, benefits, and risks. Experts weigh in on which might be the better initial choice for investors, whether you’re a novice or someone with a few transactions under your belt.

The Appeal of Gold

Gold has been a symbol of wealth and stability for centuries. Its rarity contributes to its allure, making it a treasured asset for many investors.

One significant aspect of gold is its historical resilience during economic downturns. When markets tumble, gold frequently holds its value or even appreciates.

Economic Security and Inflation Hedge

Gold acts as a hedge against inflation. When currency values decline or economic uncertainty looms, investors flock to gold. Its intrinsic value often makes it a safe haven. This helps explain why many people consider it a solid starting point for precious metal investments.

Liquidity and Market Demand

The liquidity of gold is another factor worth noting. It’s easy to buy and sell, with a well-established market. High demand from various sectors, including technology and jewelry, supports its value. This makes gold a practical first choice for many investors looking to secure their wealth.

The Lure of Silver

Silver often takes a back seat to gold, but it boasts its own unique advantages. While it’s less expensive than gold, silver has industrial applications that can drive its demand, especially in areas like electronics and renewable energy.

Affordability and Accessibility

Silver’s lower price point makes it more accessible for new investors. You can acquire more silver for the same investment amount compared to gold. This allows for diversification within your portfolio without breaking the bank.

Industrial Demand

Silver’s industrial applications are noteworthy. The metal plays a crucial role in photovoltaic cells used in solar panels and in various electronic devices.

As industries grow, so too might silver’s demand, potentially leading to price increases. This unique characteristic can make silver an attractive option to consider when investing.

Risk Factors to Weigh

When deciding between gold and silver, understanding the risks associated with both metals is essential. Each has its own market volatility and price fluctuations.

Price Volatility in Silver

While silver may be affordable, it’s also more volatile. Its price can swing dramatically based on market trends or industrial demand shifts. This unpredictability might deter some investors, especially those who prefer stable assets.

Gold’s Storage and Value Fluctuation

On the flip side, gold also faces risks. The storage and insurance costs can add up if you’re investing significantly. While its value is generally more stable than silver, it isn’t immune to fluctuations.

Investment Strategies for Beginners

Navigating the precious metals market can feel overwhelming. However, starting with a clear strategy can simplify the process.

Dollar-Cost Averaging

One popular method is dollar-cost averaging. This involves consistently investing a fixed amount in either gold or silver over time, regardless of market conditions. By doing so, you can average out the purchase price, potentially reducing the impact of volatility.

Diversification for Balance

Another strategy is diversification. This means investing in both gold and silver, allowing for a balanced portfolio. By splitting your investment, you can take advantage of gold’s stability and silver’s growth potential.

Physical vs. Paper Investments

Another crucial consideration is whether to invest in physical metals or financial instruments like ETFs (Exchange-Traded Funds) that track their value.

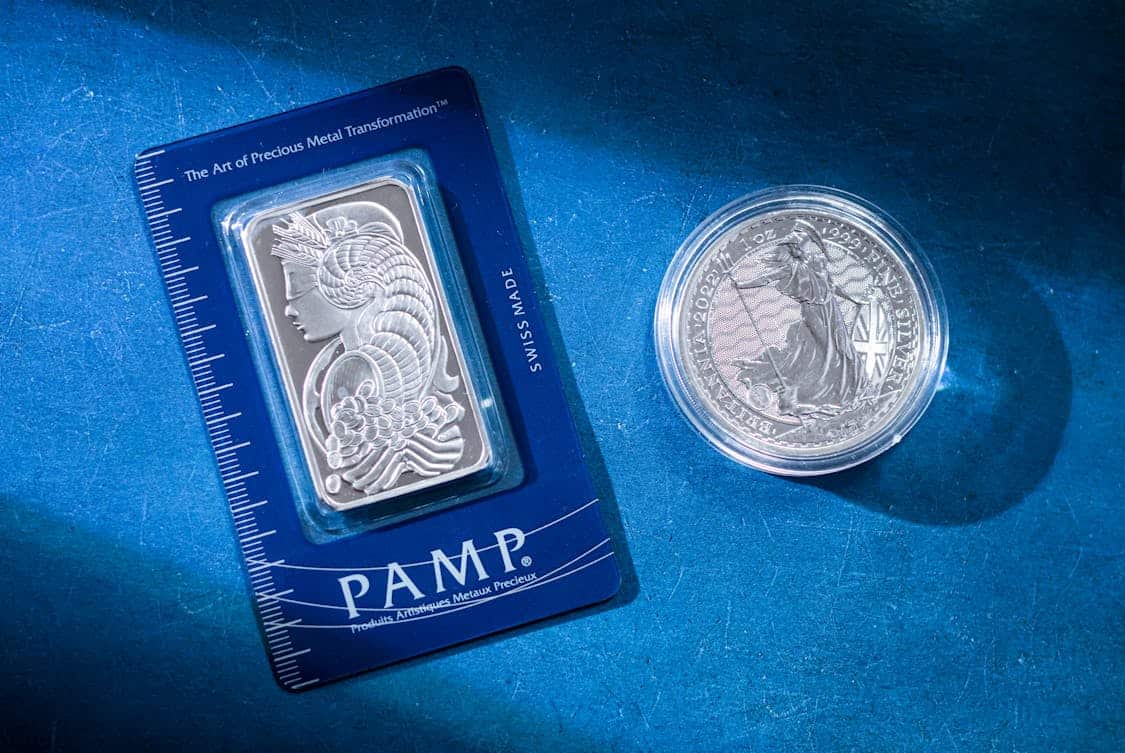

The Case for Physical Metals

Buying physical gold or silver gives you tangible assets. There’s a sense of security in holding something you can see and touch. Physical metals can also serve as a hedge against systemic risks in the financial system.

If you’re considering purchasing physical bullion, many investors trust Money Metals for its transparency, quality, and competitive pricing.

Paper Investments and Convenience

On the other hand, paper investments offer convenience. ETFs and stocks can be bought and sold quickly, usually with lower fees than those associated with physical purchases. However, they don’t provide the same sense of ownership and security.

Expert Opinions on Picking a Starting Point

Experts frequently debate which metal should be the first purchase for new investors. Some lean toward gold, while others advocate for silver.

The Gold Advocates

Many financial advisors argue in favor of gold as the first buy. They point out its long-standing history as a store of value and its ability to weather economic storms. Gold tends to retain its worth better in times of crisis, making it a solid entry point for investors wary of market volatility.

The Silver Supporters

Conversely, some experts highlight silver’s unique potential for industrial growth. They emphasize that, while it might be more volatile, the potential for significant returns could be worth the risk. For those with a higher risk tolerance, starting with silver can lead to substantial gains if the market trends favorably.

Market Trends and Future Outlook

Keeping an eye on current market trends can provide valuable insights into which metal might be a better investment.

Gold Market Insights

The gold market often reacts to geopolitical tensions and economic data. When uncertainty reigns, gold prices typically rise. This consistent behavior makes gold a reliable option for conservative investors.

Silver Market Dynamics

The silver market, while more volatile, responds uniquely to economic stimuli. The growth of green technologies and advancements in electronics can drive demand.

Keeping abreast of industry trends can help you anticipate potential price movements, making silver an exciting option for investors willing to ride the waves.